Waiting in the queue at toll plazas is no more sensible as Indian roads are becoming more and more crowded. This is where FASTag comes into play and helps you automatically pay tolls without cash and save a lot of time. Among the many FASTag providers in India, HDFC FASTag is a top choice. This Tag easily integrates with users’ HDFC bank accounts and allows them to manage their tag and make payments across toll plazas in the country.

HDFC FASTag supports government efforts towards digital transactions in addition to helping to cut travel time. Whether your travel frequency is irregular or daily, knowing how to get and handle your FASTag is absolutely vital. Keep reading as we uncover everything you need to know, from applying for an HDFC FASTag and checking balances to recharging and resolving problems via customer support.

What is HDFC FASTag?

HDFC FASTag is an electronic toll-collecting system that uses radio Frequency Identification (RFID) technology and enables cashless toll payments. Directly connected to either an HDFC Bank account or a prepaid FASTag wallet, it guarantees immediate toll fee deduction upon vehicle crossing an NHAI-approved toll plaza.

Unlike cash-based toll payments, which create congestion and delays, HDFC FASTag removes operator interference so cars may pass toll booths without stopping. The tag is attached to the windshield of the car; as soon as it moves into the FASTag lane, the RFID reader reads the tag and handles the payment right away.

Apart from toll plazas, HDFC FASTag may be used for digital transactions and is approved in some parking lots. It guarantees total convenience for car owners with real-time SMS notifications, balance tracking, and several recharging options.

Key Features of HDFC FASTag

HDFC FASTag offers multiple benefits. Here’s what makes it stand out:

- Direct Bank Integration: HDFC customers can link FASTag directly to their bank account for automatic toll payments.

- Easy Recharge: Supports UPI, net banking, debit/credit cards, and HDFC mobile banking for easy balance top-ups.

- Auto-recharge Option: Never run out of balance with an automatic recharge facility.

- Nationwide Acceptance: Works at 750+ NHAI toll plazas and select parking lots across India.

- Instant SMS & Email Alerts: Receive transaction updates, balance notifications, and low-balance warnings.

- Seamless Online Account Management: Log in via the HDFC FASTag portal to check your balance, recharge history, and toll deductions.

- Dedicated Customer Support: HDFC FASTag customer care is available 24/7 to assist with complaints, lost tags, or incorrect deductions.

Eligibility Criteria for HDFC FASTag

Make sure you meet the eligibility criteria before applying for an HDFC FASTag. FASTag is meant for all kinds of four-wheelers; hence, the requirements are simple.

Who Can Apply for HDFC FASTag?

HDFC FASTag is available for:

- Individuals: Private car owners or commercial vehicle operators.

- Fleet Owners: Businesses managing multiple commercial vehicles.

- Transport Agencies: Bus and logistics companies.

Documents Required for HDFC FASTag Application

To apply for HDFC FASTag, you’ll need the following documents:

- Vehicle Registration Certificate (RC): A copy of your RC book for verification.

- KYC Documents: Any of the following:

- Aadhaar Card

- PAN Card

- Driving Licence

- Passport

- Passport-size Photograph: A recent photo of the vehicle owner.

- HDFC Account Details (Optional): If linking directly to an HDFC Bank account.

How to Apply for HDFC FASTag?

Applying for an HDFC FASTag is easy, and you have online and offline options.

Method 1: Online Application via HDFC Bank Portal

- Visit the HDFC FASTag Portal: Go to the official HDFC FASTag application page.

- Choose Individual or Corporate Option: Select whether you are applying as an individual or for a fleet.

- Fill in the Application Form: Enter your details, vehicle information, and bank account details (if applicable).

- Upload Required Documents: Submit scanned copies of your RC, KYC documents, and a passport-size photo.

- Make the Payment: Using online banking, UPI, or debit or credit card, pay the minimum balance required, security deposit, and tag issuing fee.

- Receive & Activate FASTag: Your FASTag should arrive at your address once authorised. Just attach it to the windscreen of your car and activate it using the HDFC FASTag login page.

Method 2: Offline Application at HDFC Bank Branches

If you prefer an offline approach, you can visit any HDFC Bank branch that provides FASTag services. Follow these steps:

- Visit an HDFC FASTag Issuing Branch: Locate the nearest HDFC FASTag centre or branch.

- Submit Your Documents: Carry a copy of your RC, KYC documents, and a passport-size photograph.

- Make the Required Payment: At the branch counter, pay the issuing charge and starting balance.

- Receive Your FASTag Instantly: The bank will hand over an activated FASTag, which you can use immediately.

HDFC FASTag Fees & Charges

FASTag pricing varies based on vehicle type and includes multiple components. Here’s a breakdown of the charges:

HDFC FASTag Charges (as per Vehicle Category)

| Vehicle Type | Tag Issuance Fee | Security Deposit | Minimum Balance |

| Car / Jeep / Van | Rs.100 | Rs.200 | Rs.200 |

| Light Commercial Vehicle (LCV) | Rs.100 | Rs.300 | Rs.300 |

| Truck / Bus (2 Axle) | Rs.100 | Rs.400 | Rs.400 |

| Heavy Commercial Vehicle (3+ Axle) | Rs.100 | Rs.500 | Rs.500 |

Other Important Charges

- Tag Replacement Fee: Rs.100 (if your FASTag is lost or damaged).

- Recharge Convenience Fee: This may apply based on your payment method (Net banking, UPI, debit/credit card).

- Inactive FASTag Penalty: If the balance goes below the minimum limit, the FASTag may be temporarily blocked.

How to Recharge HDFC FASTag?

A sufficiently recharged HDFC FASTag prevents toll payment issues. HDFC Bank offers multiple options to recharge their FASTag accounts.

Ways to Recharge HDFC FASTag Online

You can recharge your FASTag using the following methods:

1. Through the HDFC FASTag Portal

- Enter your credentials to log onto the HDFC FASTag portal.

- Head to the “Recharge FASTag” section.

- Enter the amount you wish to add and choose a payment method (Net banking, UPI, debit/credit card).

- Complete the transaction, and the amount will be added instantly.

2. Using HDFC Net Banking or Mobile Banking

- Log in to HDFC Net Banking or the Mobile App.

- Go to Bill Payments → FASTag Recharge.

- Enter your FASTag Wallet ID or registered vehicle number.

- Select the amount and complete the payment.

3. Recharge via UPI (Google Pay, PhonePe, Paytm, etc.)

- Open any UPI-enabled app and go to “Send Money”.

- Enter your FASTag UPI ID (Format: NETC.<VehicleNumber>@hdfcbank).

- Enter the recharge amount and confirm the transaction.

4. Auto Recharge Setup

- Through HDFC Bank, users can set up an auto-recharge feature which will replenish their account balance anytime it falls below a predetermined threshold.

HDFC FASTag Login & Account Management

Using the HDFC FASTag login portal, you can easily manage your account, check recharge history and view toll transactions.

How to Access Your HDFC FASTag Account?

- Visit the HDFC FASTag Portal: Go to HDFC Bank’s official FASTag login page.

- Enter Login Credentials: Use your registered mobile number and password.

- Navigate Dashboard Options: View your current balance, past transactions, recharge history, and account settings.

Key Account Management Features

- Available funds appear immediately through the Balance Check feature on the device.

- Users can view all prior top-up transactions together with deductions through the Recharge History feature.

- Users can file complaints about incorrect toll deductions that occur through Transaction Dispute Resolution.

- FASTag can deactivate or block their tags when the tag is stolen or lost

HDFC also provides a bulk FASTag managing facility for corporate users so that companies may monitor several car tags under one account.

HDFC FASTag Customer Care & Support

Have problems using your FASTag? For questions, conflicts, and complaints, HDFC offers a specifically designed customer care system.

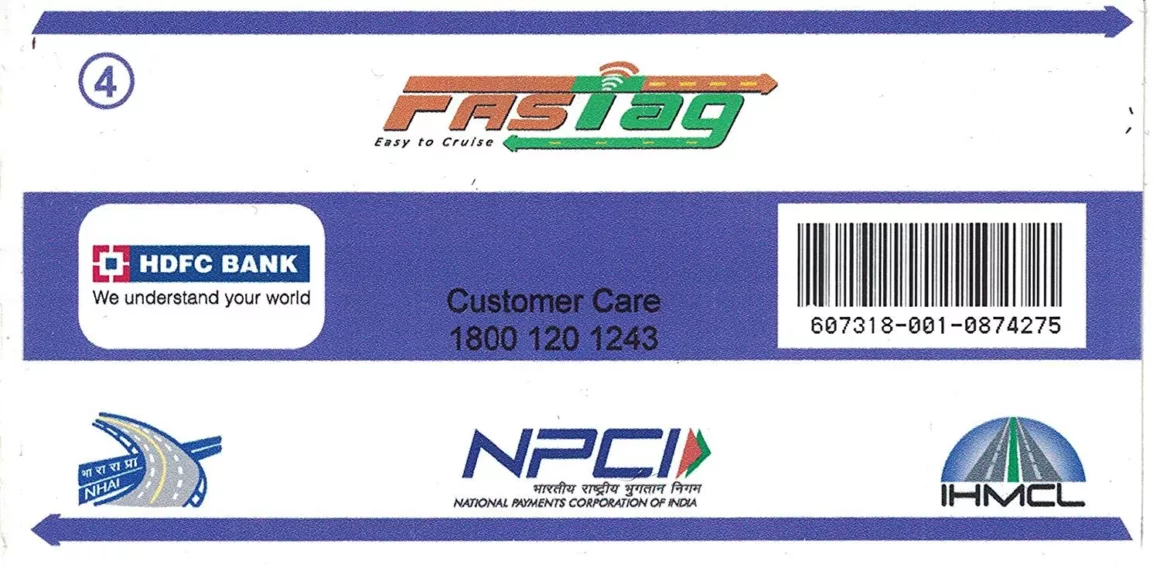

HDFC FASTag Customer Care Number & Email

- 24×7 Toll-Free Helpline: 1800 120 1243

- Email Support: Send queries to [email protected]

- SMS Alerts: Send FASTAG BAL <VehicleNumber> to 567676 to check your balance instantly.

Conclusion

HDFC FASTag is not only a toll payment system but also a necessary upgrade for highway travel. Whether your journey is long-distance or a daily commute, a dependable and well-managed FASTag guarantees you never spend time in cash lines. Among the finest options for FASTag users in India, HDFC stands out for its strong banking network, automatic recharges, and solid customer support system.

Maintaining your balance, tracking transactions via the HDFC FASTag login page, and using the auto-recharge function will help you prevent disruptions for hassle-free operation. With the right approach, you’ll never have to think twice about toll payments again.

FAQs

Q. How can I apply for HDFC FASTag online?

Visit the official HDFC FASTag portal, complete the HDFC FASTag application form, submit pertinent documentation, and pay for HDFC FASTag. You may also apply through certain toll plazas or HDFC Bank offices.

Q. What are the customer care details for HDFC FASTag?

For any problems, you can connect at [email protected] or HDFC FASTag customer service at 1800 120 1243. To immediately check your balance, send FASTAG BAL to 567676.

Q. How do I log in to my HDFC FASTag account?

To check your balance, recharge history, and handle your account, visit the HDFC FASTag login page and enter your registered mobile number and password to log in.

Q. How long does it take for an HDFC FASTag recharge to reflect?

Most recharges show immediately. Rarely, though, it can take up to half an hour. Get help from HDFC FASTag customer support if the recharge does not reflect.

Q. What should I do if my HDFC FASTag is lost or damaged?

If your FASTag is lost or destroyed, log in to your HDFC FASTag account, ask for a new tag, and connect it to your current account. Alternatively, get help from customer care.